Crypto

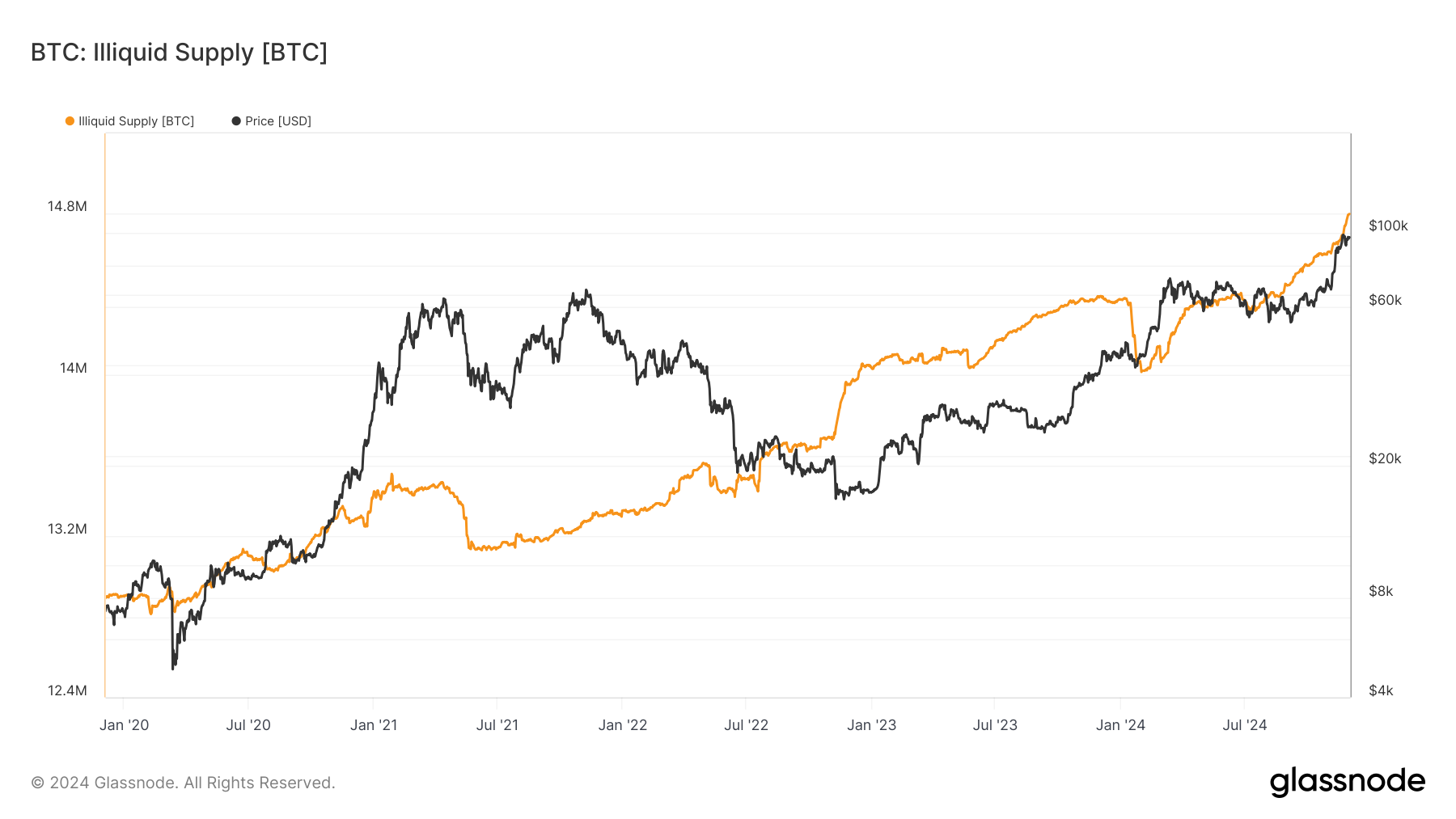

Crypto Bitcoin’s ‘Illiquid’ Supply Soars to New All-Time High Near 15M Tokens

Crypto Alongside, bitcoin on exchanges have fallen to almost a four-year low, suggesting heightened investor demand.

Updated Dec 2, 2024, 6:24 p.m. UTCPublished Dec 2, 2024, 3:14 p.m. UTC

The so-called $100,000 sell wall for bitcoin (BTC} is becoming a hard nut to crack, with $384 million available for sale between the current price and that six-figure milestone. A look at the supply data, though, suggests building pressure for an upward move.

“Illiquid supply” refers to the amount of bitcoin that is owned by long-term holders (LTHs) that is not actively traded. According to Glassnode data, illiquid supply has risen by more than 185,000 tokens over the past 30 days and hit an all-time high of 14.8 million BTC, or 75% of the total circulating supply of just under 20 million (only 21 million bitcoin can ever exist). That 185,000 is the second highest 30-day change this year and suggests the main behavior for investors at the moment is holding not trading.

Previous research by CoinDesk shows that sales by LTHs are approaching their end. Since Nov. 26, LTHs as a group have been accumulating, adding more than 2,000 BTC to their stacks. This could mean that the period of realizing profits is coming to an end for this cohort, possibly taking further sell pressure from the market.

Coins are rapidly leaving exchanges

Since the beginning of this latest bull run in early November, bitcoin tokens have been exiting exchanges at a rapid rate. This has ended a nearly two-year trend of bitcoin on exchanges at roughly steady levels, an encouraging sign of further investor demand.

Zooming out over a five-year period, however, shows a somewhat less encouraging picture as bitcoin on exchanges remains in a relatively narrow range of 2.7 million to 3.3 million tokens.

For a more sustainable bull run, BTC will need to keep leaving exchanges — a sign of continuing investor appetite rather than demand from the derivatives side which is a often sign of leverage.

“Bitcoin’s illiquid supply has reached a new all-time high while exchange balances hit a new multi-year low,” said Andre Dragosch, head of research at Bitwise. “Almost 75% of supply is deemed ‘illiquid’ while less than 14% of supply remains on exchanges,” he continued. “Bitcoin’s supply scarcity continues to intensify.”

James Van Straten

As the senior analyst at CoinDesk, specializing in Bitcoin and the macro environment. Previously, working as a research analyst at Saidler & Co., a Swiss hedge fund, introduced to on-chain analytics. James specializes in daily monitoring of ETFs, spot, futures volumes, and flows to understand how Bitcoin interacts within the financial system. James holds more than $1,000 worth of bitcoin, MicroStrategy (MSTR) and Semler Scientific (SMLR).