Crypto

![]()

Journalist

Share this article

- Despite recent bouts of decline, Bitcoin remains close to the $10,000-level

- Miners dumped their biggest batch of holdings in months as its price hit a major milestone

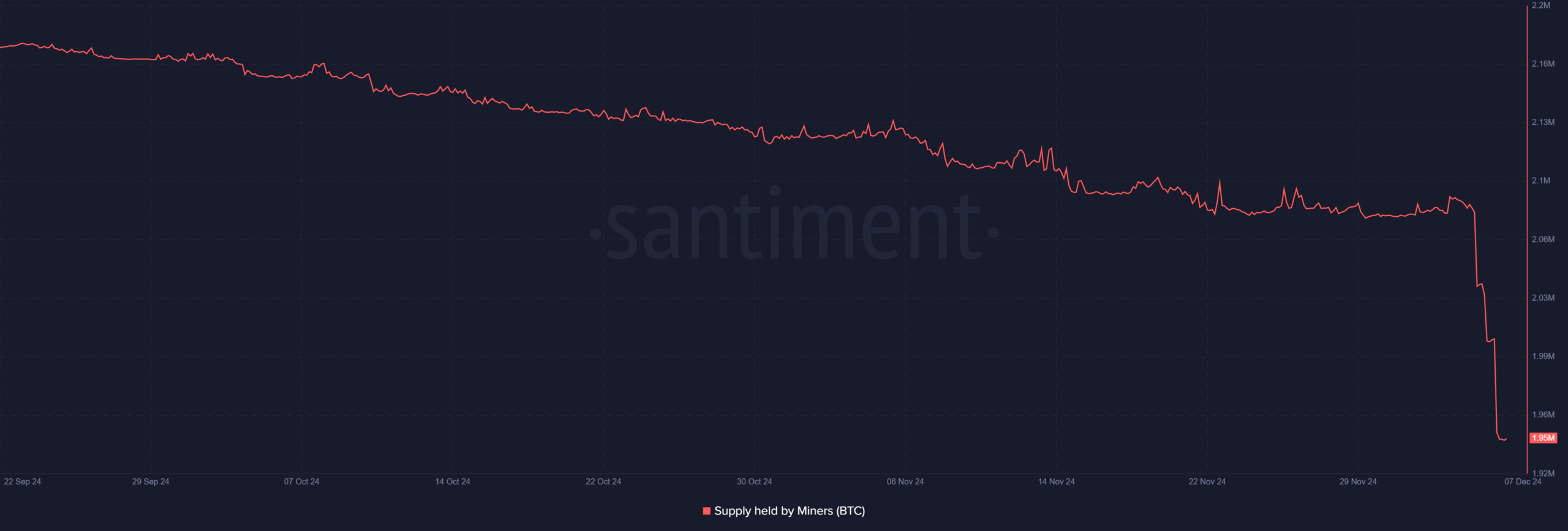

Bitcoin miners have offloaded a staggering 85,503 BTC over the last 48 hours, causing miner balances to drop to approximately 1.95 million BTC – Their lowest level in recent months. In fact, this marks the sharpest fall in miner holdings in 2024.

As expected, this raises questions about its impact on Bitcoin’s price too.

Crypto Bitcoin miners’ selling and price trends

The recent dip in miner balances is the most significant since February, but it has not yet directly affected Bitcoin’s price momentum. An analysis of the miner supply on Santiment revealed that on 5 December, it had a reading of over 2 million.

However, it had dropped to around 1.95 million, at the time of writing.

Historically, significant miner sell-offs often align with market corrections, but 2024 has seen a divergence between miner activity and price trends. Despite these sell-offs, however, non-mining whales and sharks have continued to accumulate – Highlighting the complexity of market dynamics.

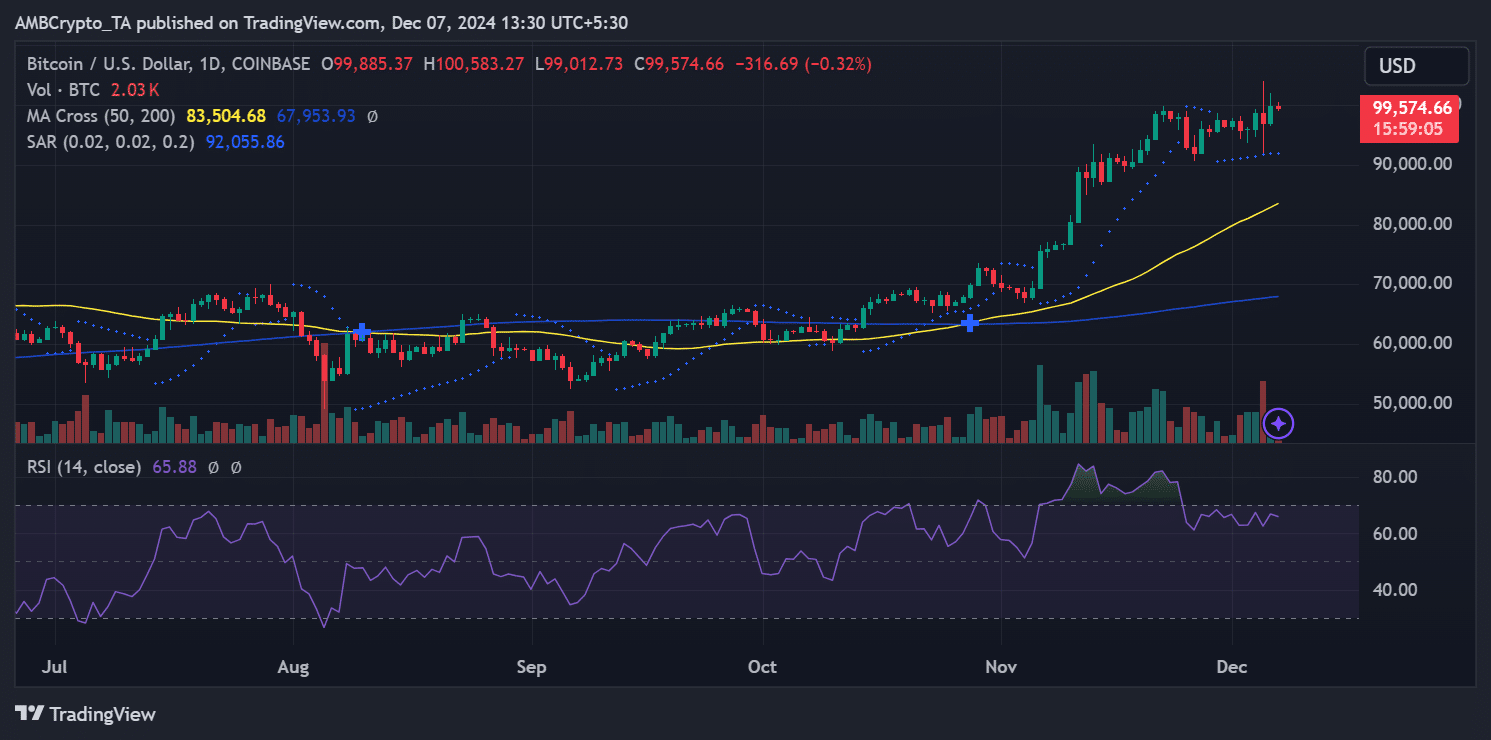

At press time, Bitcoin seemed to be consolidating near its psychological resistance at $100,000. The Relative Strength Index (RSI) highlighted a value of 65.88 – A sign that the asset remains in bullish territory, although overbought conditions were not yet evident.

The Parabolic SAR and moving averages further supported a bullish bias, with the price trading well above the 50-day and 200-day moving averages at $83,504 and $67,953, respectively.

Crypto Network metrics – Hashrate, difficulty, and revenue

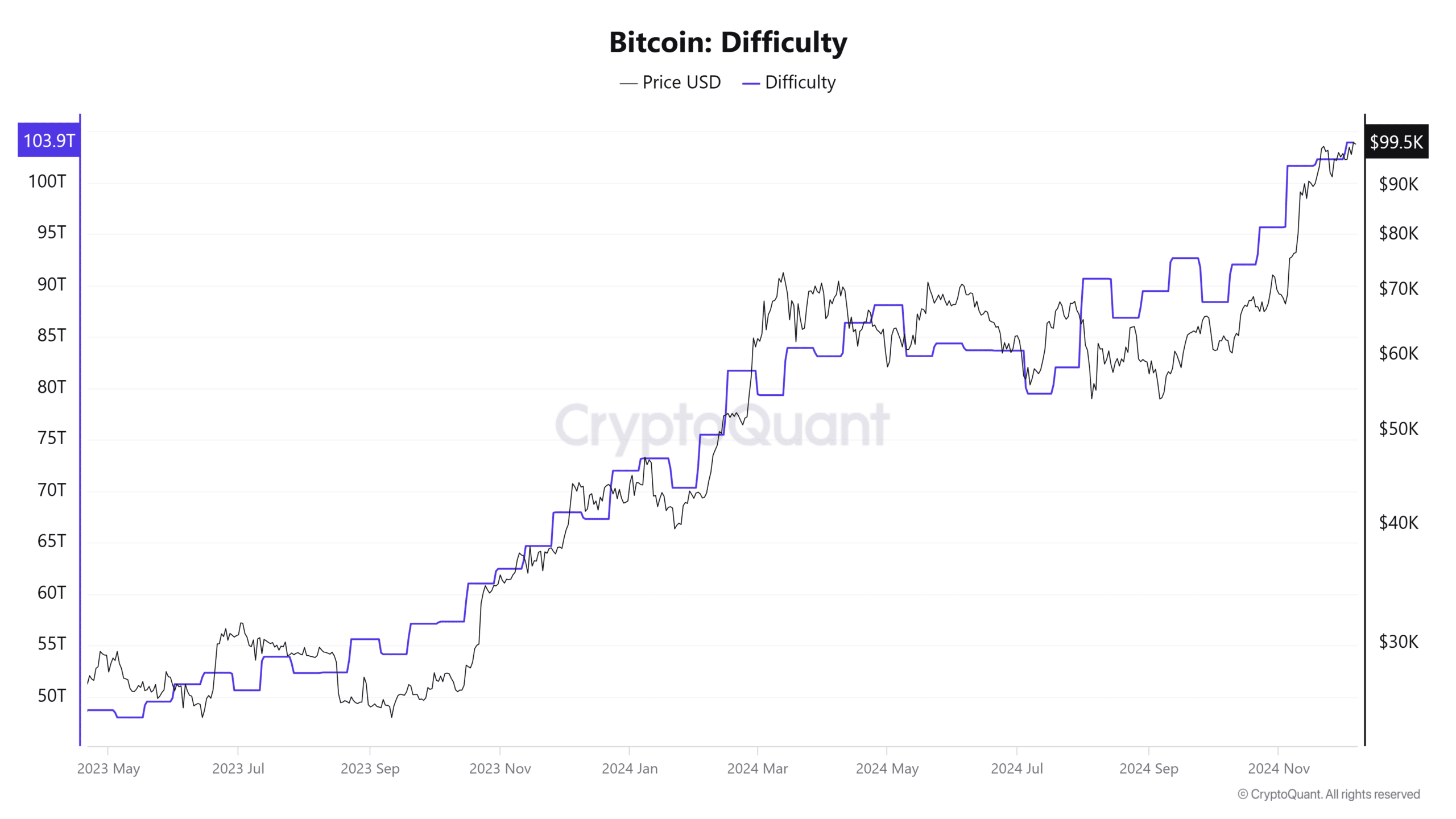

An analysis of Bitcoin’s hashrate revealed that it hit an all-time high of over 900 EH/s. The sustained hike indicated strong competition among miners.

Coupled with a record network difficulty of 103.9T, high mining activity has continued despite the fall in miner balances.

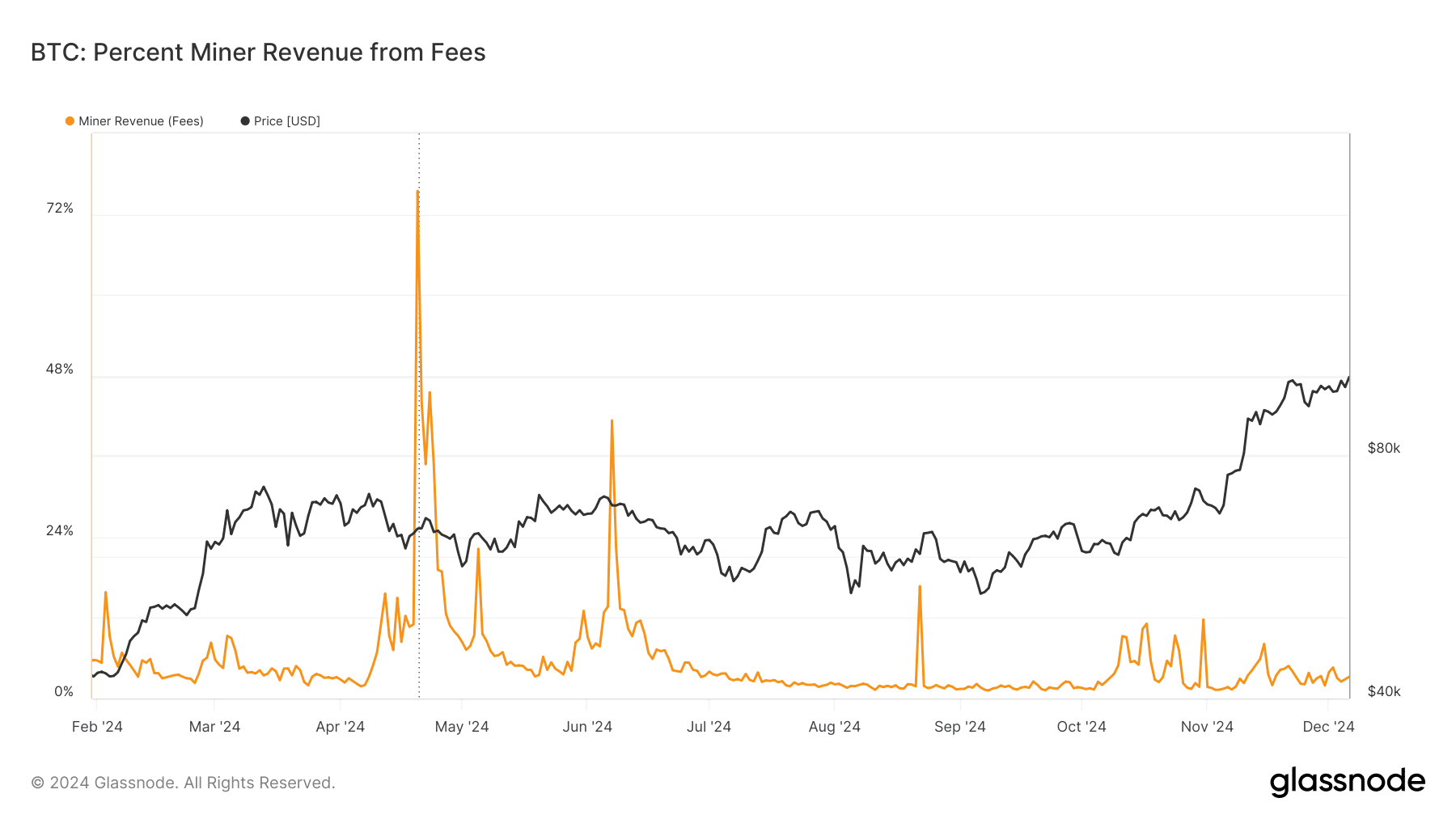

Furthermore, miner revenue from fees remains subdued, with transaction fees contributing to only about 10% of total miner earnings.

This is significantly lower than the peaks seen earlier in 2024, emphasizing miners’ dependence on block rewards.

Crypto Implications for Bitcoin’s price

The divergence between miner activity and price trends underscored Bitcoin’s market maturity. Despite major sell-offs, Bitcoin’s price has remained resilient, consolidating near its all-time high as buyers stepped in to absorb the selling pressure. However, sustained selling from miners could lead to heightened volatility, especially if compounded by macroeconomic or liquidity concerns.

Bitcoin’s ability to maintain its price near $100,000 amid significant miner selling reflects the growing influence of non-mining market participants and the asset’s broader adoption.

Read Bitcoin (BTC) Price Prediction 2024-25

As miners adjust their holdings, market participants will closely watch Bitcoin’s ability to break past its psychological resistance and sustain its rally. The coming weeks will be critical for determining whether the recent miner sell-off means a potential turning point or merely reflects short-term market adjustments.