Crypto

Home » Bitcoin » AI-driven Genius Group stock soars 11% as firm expands Bitcoin Treasury to $30 million

Crypto The company enhances its strategic financial position by focusing on Bitcoin for long-term treasury management.

Photo: Genius Group

Key Takeaways

- Genius Group stock rose 11% after the firm expanded its Bitcoin Treasury to $30 million.

- The company reported a 1,649% BTC yield since its initial acquisition in November.

Share this article

Genius Group Limited (GNS) stock rose 11% to approximately $0.72 in early US trading Monday after the AI-driven education company said it had expanded its Bitcoin holdings to $30 million, according to Yahoo Finance.

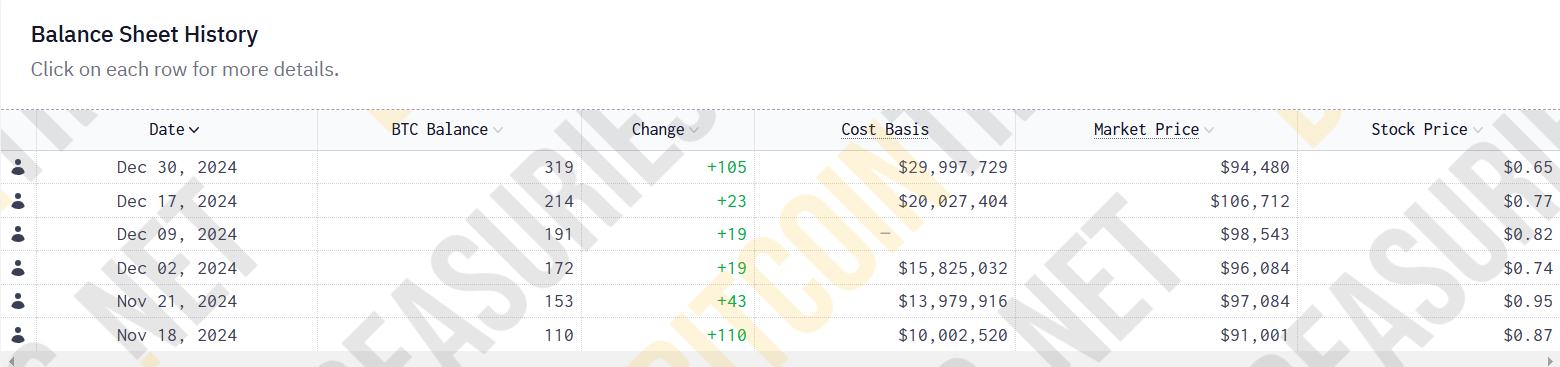

The company increased its Bitcoin Treasury by $10 million, bringing its total holdings to 319.4 Bitcoin, according to a Monday statement.

The expansion comes as Genius Group reported a 177% increase in net asset value to over $54 million in the first half of 2024, surpassing its market capitalization of more than $40 million.

The company also introduced BTC Yield as a new performance metric, achieving a 1,649% yield since its initial Bitcoin acquisition in November.

Genius Group first revealed plans to hold 90% or more of its reserves in Bitcoin in November, with an initial target of $120 million. The company has since made regular purchases, starting with a $10 million investment on November 18.

“We have been buying Bitcoin consistently and are pleased to be ahead of our internal schedule to reach our initial target of 1,000 Bitcoin in our Treasury,” said Genius Group CEO Roger Hamilton.

The Bitcoin purchases were funded through a combination of reserves, ATM proceeds, and a $10 million Bitcoin loan from Arch Lending.

As of December 29, 2024, the Bitcoin Treasury was valued at $30.4 million based on Bitcoin’s price of $95,060, while the company’s market cap was $40.6 million, resulting in a BTC/Price ratio of 75%.

“Whilst we are pleased to be achieving a high BTC yield, we believe our Bitcoin performance is not yet reflected in our share price. This is indicated by Genius Group having a high BTC / Price ratio of 75%, which we believe is significantly higher than our industry peers,” said Genius Group CFO Gaurav Dama.

Share this article