Crypto

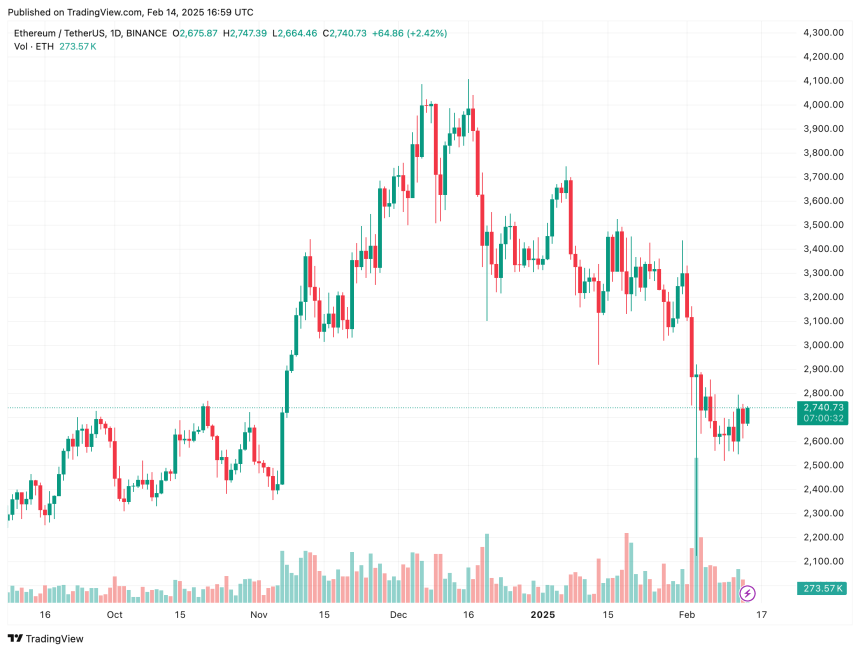

Despite a volatile past two weeks, driven by Donald Trump’s proposed trade tariffs and higher-than-expected January 2025 inflation data in the US, Ethereum (ETH) has successfully defended the $2,380–$2,460 demand zone. Now, analysts are eyeing a potential move toward $3,000 for the digital asset.

Crypto Ethereum Defends Key Demand Zone Amidst Volatility

According to an X post by crypto analyst Ali Martinez, ETH has managed to hold above the critical $2,380 – $2,460 demand zone. With no major supply barriers ahead, the cryptocurrency could be on track to reach the $3,000 price target.

For the uninitiated, a demand zone in trading is a price area where buying pressure is significantly strong, often leading to price reversals or upward movements. It is identified by historical price action, where demand previously exceeded supply, causing prices to rise.

Crypto trader Daan Crypto Trades shares a similar outlook on Ethereum’s recent price momentum. According to the trader, while ETH has successfully remained above the $2,500 level, the key hurdle to overcome is the $2,800 price level. They noted:

The key level for continuation, and for me to say that this correction is over, would be a retake of that $2.8K level. Flips the market structure locally and has been at an important high timeframe level during this cycle.

From a technical perspective, fellow crypto trader Merlijn The Trader highlighted the formation of a ‘textbook double bottom’ on the 5-day Ethereum chart. They further pointed out that ETH’s multi-year trendline remains intact, suggesting that the price structure is primed for an upward breakout.

Similarly, seasoned crypto influencer Crypto Rover has identified a potential triple-bottom formation on the weekly Ethereum chart. If this pattern plays out, the $4,000 resistance level will be a crucial barrier for ETH to break before it can attempt a new all-time high (ATH).

Crypto Is ETH About To Surprise The Market?

Ethereum’s below-average price performance over the past year has drawn significant attention in the crypto market. Compared to peers like Solana (SOL), XRP, and SUI, ETH has failed to deliver substantial returns to its holders since reaching its current ATH of $4,878 in November 2021.

This lackluster performance has fuelled an unprecedented level of bearish sentiment around ETH. A recent report revealed that ETH short positions have surged by 500% since November, highlighting dwindling investor confidence in the asset.

However, this excessive bearish sentiment could set the stage for a surprise move. If ETH manages to trigger a short squeeze, it could force the liquidation of numerous short positions, fuelling a sharp upside rally. At press time, ETH trades at $2,740, up 4.1% in the past 24 hours.

Featured image from Unsplash, Charts from X and TradingView.com