Crypto

![]()

Journalist

Share this article

- Bitcoin’s short-term holders show restraint, reducing selling pressure and signaling potential for stable growth.

- With less speculative capital, Bitcoin’s market is becoming more resilient, indicating reduced downside volatility.

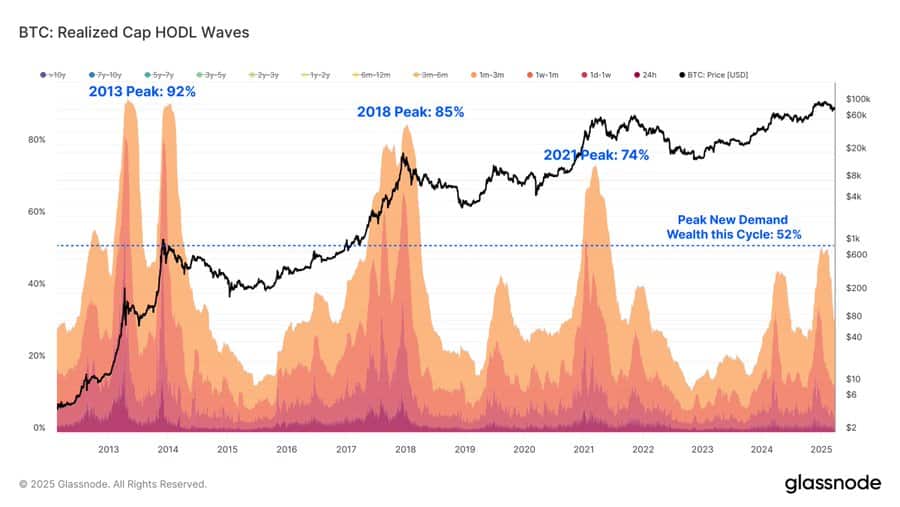

Bitcoin [BTC] is navigating volatile conditions, with a notable shift among short-term holders (STHs), who now control 40% of the network’s wealth.

Despite recent losses, these typically reactive sellers are showing restraint, reducing selling pressure.

While this is far below past peaks, where new investor wealth reached 70-90%, it signals a more balanced, tempered bull market.

This shift suggests a potential turning point for Bitcoin, with less downside volatility, paving the way for stability and growth.

A more evenly distributed market cycle

In previous bull cycles, STHs controlled 70-90% of the network’s wealth at peak demand, as seen in 2013 (92%), 2018 (85%), and 2021 (74%).

However, in the current cycle, this figure has only reached 52%, reflecting a more balanced distribution of BTC ownership.

This suggests that LTHs are maintaining stronger conviction, reducing the dominance of speculative capital. With fewer newcomers driving extreme volatility, Bitcoin’s market structure appears more resilient.

What does this mean for BTC’s future?

The easing selling pressure from short-term holders suggests Bitcoin’s price may experience reduced volatility, fostering a more stable uptrend.

With long-term holders maintaining a dominant share, the market structure appears less reliant on speculative surges, reinforcing sustainability.

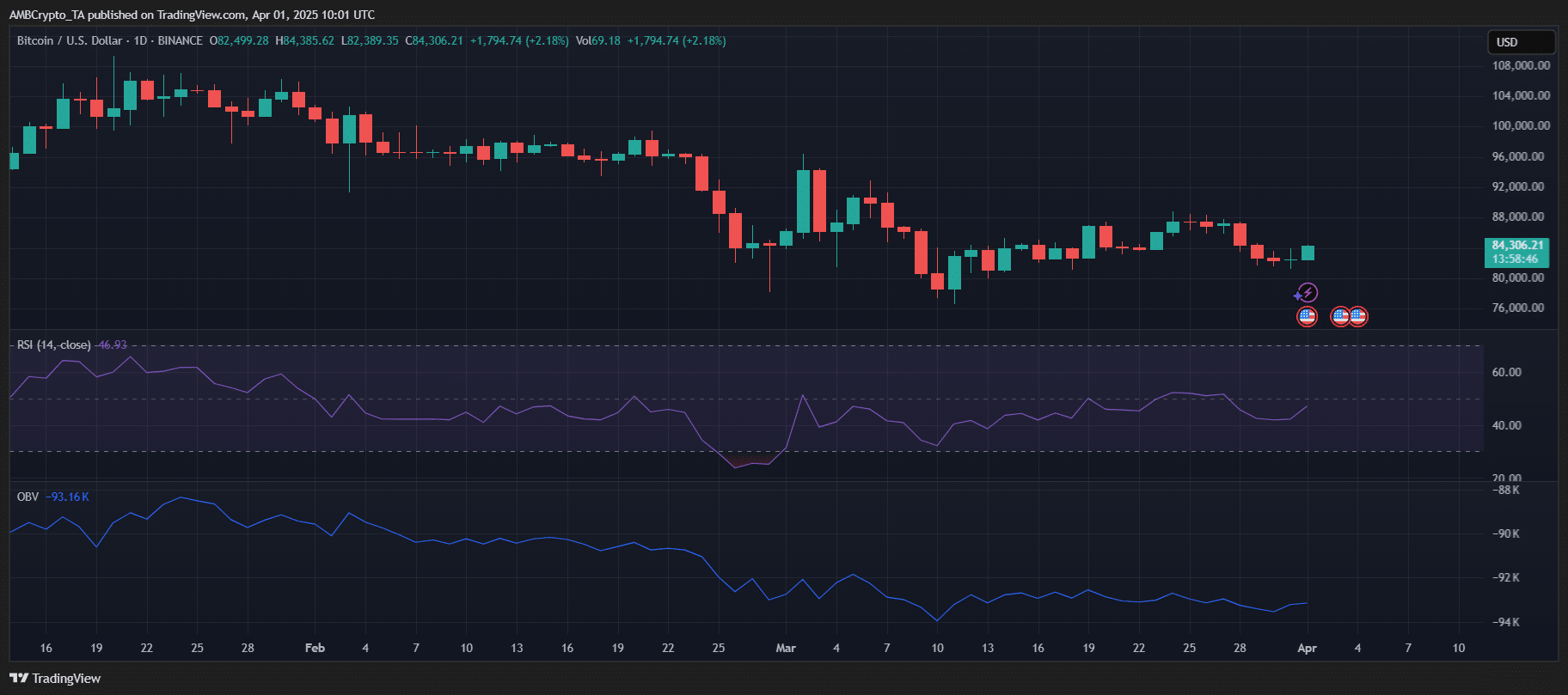

BTC is hovering near $84K, with RSI at 46.93 — indicating neutral momentum.

If buying pressure strengthens, BTC could regain bullish momentum; otherwise, consolidation or minor pullbacks may continue. Overall, this shift hints at a maturing market, where extreme price swings are less frequent.